By: Gabrielle Luoma CPA, CGMA

By: Gabrielle Luoma CPA, CGMA

One of the best ways to save money in tax deductions [as a small business owner] is to track your business miles driven. Self-employed individuals have access to the highest deduction rates as well as the fewest restrictions with mileage tracking. It would be silly to ignore this opportunity! Keep reading to hear more about how you can save money tracking your miles in 2020!

Make Mileage Tracking Easy by using an app!

The first app we would recommend for Mileage Tracking isMileIQ. MileIQ is a program connected to Microsoft and is included in a Microsoft 365 Business Premium subscription. Of course, you can also download the app independently of that. MileIQ will automatically record your drives and send reports via email. Once you finish a drive, the drive will show up in your feed and you can then classify it as business or personal. Something cool about both apps is they show you how much the drive might be worth (in dollars). You can break down the drives into more specific categories like, “between offices,” “customer visit,” “airport/travel,” and so on. You can log up to 40 trips a month for free.

Another app you could use isQuickBooks Self Employed. Mileage Tracking is among many other features in this app. As long as you have “automatic tracking” turned on, QB Self Employed app will track your drives and create reports just like MileIQ. Your miles will be tracked even if you don’t have the app open. Another cool feature is QB Self Employed will remember your common routes so you don’t have to categorize repeat trips.

How to get your full deduction with Mileage Tracking

If you want to get your full deduction, you will have to make sure thatyour log is thorough. If you would like to forgo the use of an app, you must make sure you are taking note of:

- The date of your trip

- Where you started from & your vehicle mileage at the start point

- Where you are going & your vehicle mileage at the end point

- Trip related costs (tolls, parking)

- The purpose of your trip

Provide these reports to your tax preparer during tax time to receive the deduction on your tax return.

What is the actual deduction

TheIRS updated its mileage deduction ratesat the beginning of 2020. The new rates are as follows:

“57.5 cents per mile driven for business use, down one half of a cent from the rate for 2019,

17 cents per mile driven for medical or moving purposes, down three cents from the rate for 2019, and

14 cents per mile driven in service of charitable organizations.”

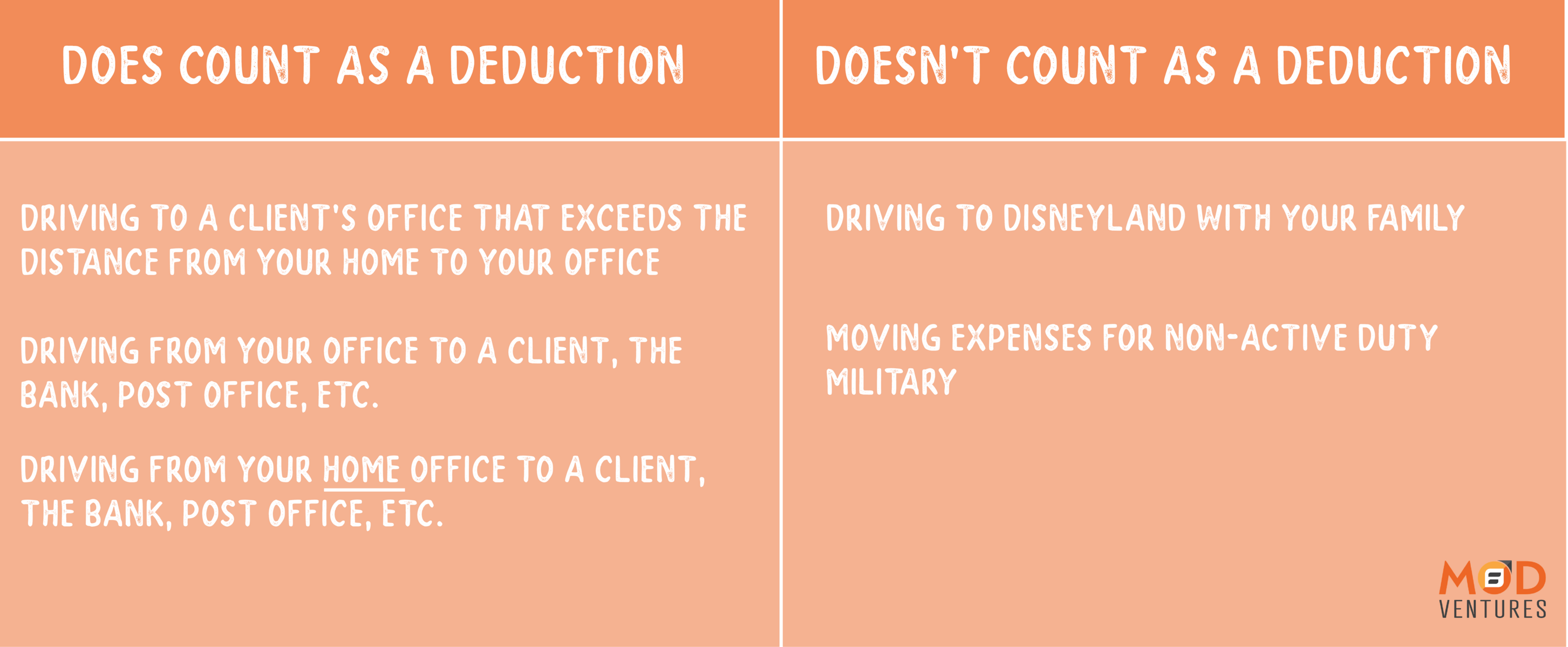

What does and doesn’t count for a deduction with mileage tracking

*This graphic in no way covers everything that does and doesn’t count, but will hopefully give you a nice idea. If you want to see the full guidelines from the IRS about travel, vehicle and gift expenses, click here.

Here is a technical summary from the Journal of Accountancy dated January 2, 2020, for the most up to date guidance on mileage tracking,click here.

If you have questions about setting yourself up in QuickBooks Self Employed,contact usand we would be happy to answer your questions!

You May Also Love

CLOSE